Online Payday Loan Originations Over the Years in US

Payday Loans appeared 20 years ago and have definitely undergone multiple changes in regulations, usage, popularity and more.

PAYDAY LOANS USA ONLINE -

REQUEST FORM

- Available even for bad credit applicants.

- Applying doesn't affect your credit score!

Get Your Money in a Few Clicks

We keep your personal information secured!

By submitting my information, I acknowledge I have read, understand, and agree to the terms of the Privacy Policy and the Terms of Use , I understand that by submitting my information, I may be contacted by telephone by one lender.

If you put a tick, you choose to apply for a Car Title Loan and get instant direct deposit into your bank account with no credit check, no inspection.

Get a Payday Loan Online

in 3 easy steps

Online Payday Loan Originations Over the Years in US

In the USA, there are many ways to get a Payday Loan. As a matter of fact, it is easier to get cash advance online with payday loans than it is at a bank or financial institution. The loan originators (lenders) allow you to fill out all the paperwork online and they analyze your application based on all the information contained in the application. This is usually done in just 24 hours.

We’ve done research on how the popularity of Payday Loans had changed within years. We also pay attention to the updates in short-term laws, allowed amounts, terms and limits o interest rates.

Payday Loans Origin and History

About 20 years ago, a new financial product called the payday loan began to spread across the U.S. It allowed customers who needed cash quickly to borrow money and use their next paycheck as collateral.

In 1992, Colorado introduced lump-sum payday loans. They were an early adopter, but things are different now. In 2010, the state realized that the payday loan market in Colorado had failed and took action. Now, borrowers in Colorado pay an average of 4% of their paycheck to service their loans, which is less than they would if they used a conventional lump-sum payday loan (average annual percentage rate 129%). These loans are still costly—with fees and interest, the average APR is 129%—but individuals borrowers spend 42% less money on these loans than previously.

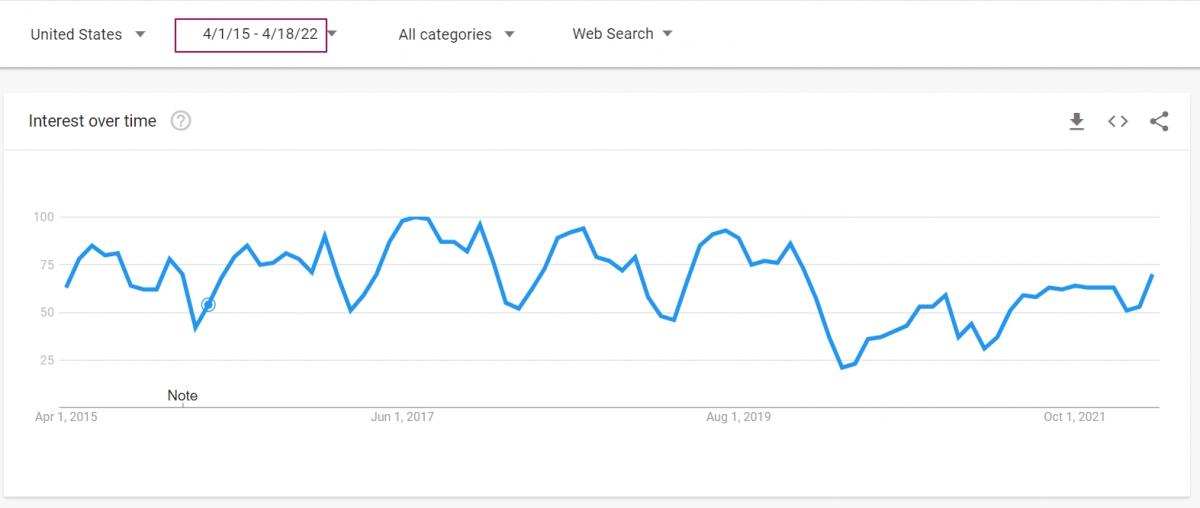

Online Payday Loans Popularity Changes Since 2015

Online Payday Loans have always been popular among Americans – 12 mln applicants have borrowed a payday loan at least once. We’ve analyzed how its popularity has been changing since 2015 to the current moment.

The infographic below shows the market share of online payday loan originations over the years. In 2015, the total number of online payday loan originations was reported to be $24 billion. The number is expected to increase to $30 billion in 2016. The number of borrowers used to drop during the times of Pandemic and Stimulus Checks of 2021. And now, in 2022 it is gaining its popularity again. This infographic is based on a report from Payday Loans USA Online:

As we can see from the picture, short-term loans have always been a popular way to get instant cash. The degree of popularity tends to rise and fall but overall it stays on the [position over 50, which means more than average.

Online Payday Loan Demographics

For people who rely on the continuous availability of payday loans, repayments can be an enormous challenge. They usually have a hard time keeping up with living expenses from month to month; most are struggling with bank overdraft fees, credit card debt and low credit scores.

The average borrower is only barely able to pay off one at a time in small increments; in a lump sum repayment scenario, they would need to be able to make more than $400 per two weeks.

Forty-one percent of borrowers believe that if payday loans did not exist, they would have to cut back on essentials such as food and clothing. Wealthier borrowers are more likely to say they would put off paying their mortgage or other large payments and resort to borrowing or hocking possessions if they were unable to get a payday loan.

As a conclusion, we may say that Online Payday Loans are meant:

- For customers with a steady income, this could be a good way to borrow money and only spend $520 in interest to repeatedly borrow $375 of credit.

- For people who are on a fixed-income or that have no savings, this kind of loan can be very dangerous.

The average payday borrower ends up borrowing again and again, spending an average of $3 in fees each time. They pay an average fee of $43 per loan for a total cost of borrowing of $520, but since the average customer's paycheck is less than the total cost, they are risking the stability of their future finances because they need to make payments from what little is left from their paycheck.

How Payday Loan Demographics Has Changed Within the Last 5 Years

According to Pewtrusts.org, 5.5% of adults have used a payday loan in the past five years. This is a fairly large number, especially when you consider that only three-quarters of payday loan borrowers use storefront lenders and one-quarter borrow online.

There are certain groups that are more likely than others to have used a payday loan in the past five years:

- Renters and those who earn less than $40,000 a year;

- Those without a four-year college degree are much more likely to have used a payday loan than those who do have one;

- African Americans are more than twice as likely to have used a payday loan than others;

- Disabled, unemployed and separated individuals are most likely to have borrowed.

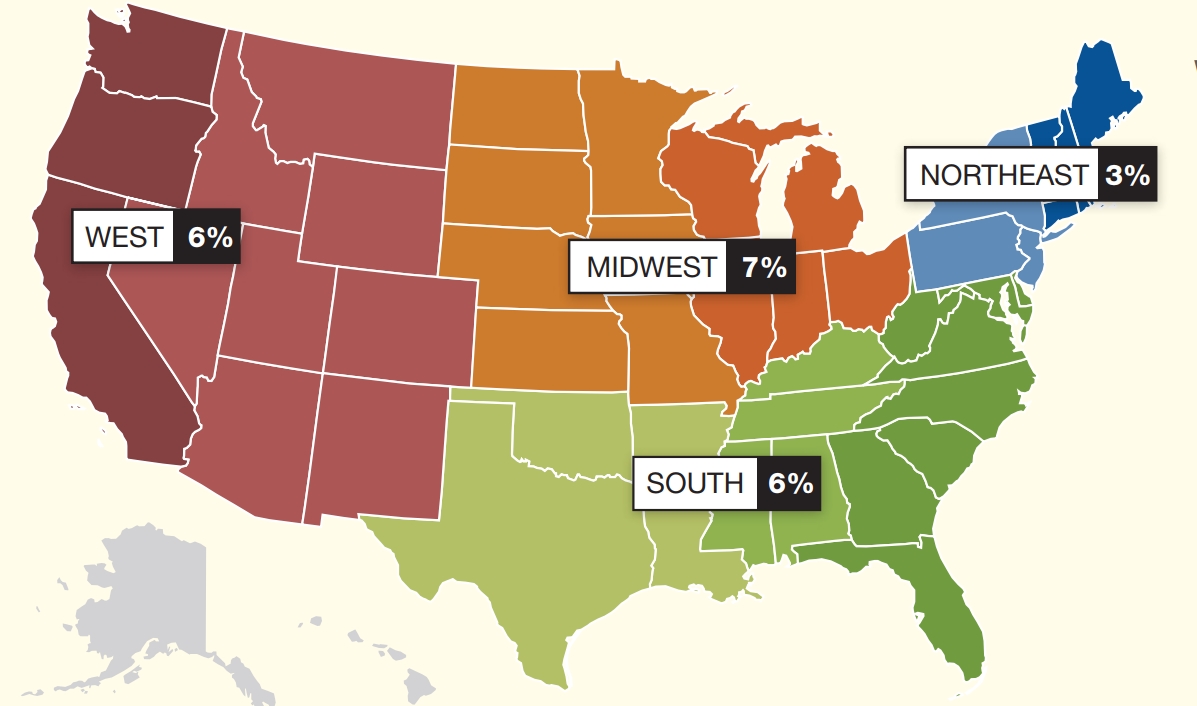

What is a Payday Loan Geography?

If we investigate the geographical grouping of Payday Loans in the USA, we’ll see the following picture:

A major factor affecting payday loan usage in different regions is the difference in regulating the loans by state. Usage rates in Oklahoma and Missouri, two of the leading states for payday loans, are much higher than the rest of the country. This is largely due to the fact that they don’t regulate them at all.

We’ve analyzed the data from Google to check how many people search for Online Payday Loans in various cities of the US and the results turn to be:

|

City |

Searches per month |

|

Los Angeles, CA |

300 |

|

Chicago, IL |

400 |

|

Houston, TX |

450 |

|

Phoenix, AZ |

200 |

|

Philadelphia, PA |

250 |

|

San Antonio, TX |

500 |

|

San Diego, CA |

250 |

Latest Changes in Online Payday Loan Regulations in the US

There are a lot of new developments happening in the payday lending industry. In the 2021 legislative session, 21 states introduced legislation related to payday lending and loans.

For example, Hawaii will be transitioning away from lump sum deferred deposit transactions to installment loans on Jan. 1, 2022.

Mississippi is making changes to how it licenses cash lenders, and New Hampshire is clarifying deadlines for consumer credit exams applicable to certain entities.

North Dakota amended three separate pieces of legislation related to deferred presentment transactions, collection agencies, and money brokers.

Conclusion

Although payday lending still exists in 27 states, it is most common in those states and only really exist in the other ones if lenders also issue payday installment loans and lines of credit. So, for lawmakers in a state that wishes to preserve access for small loans should enact comprehensive reforms like those in Colorado, Hawaii, Ohio, and Virginia.